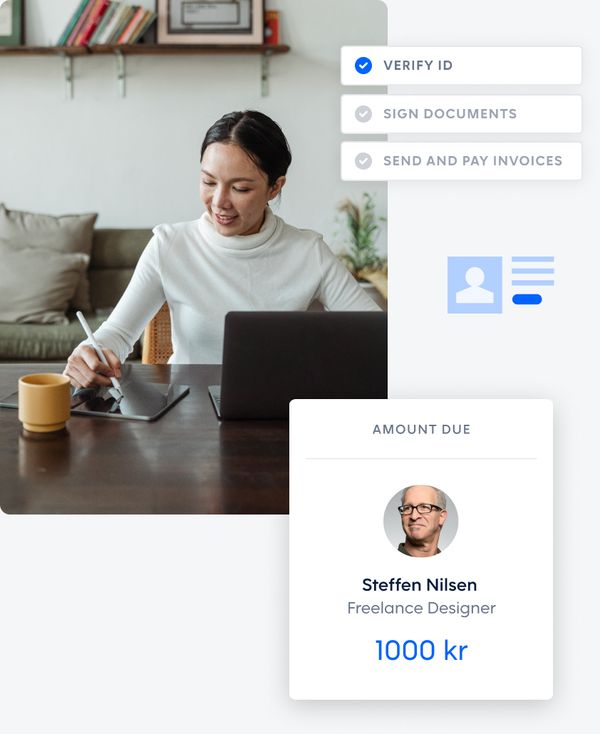

Freelancer or consultant? Invoice without a company

Did you know that you do not need a company to get paid as freelancer? No administration, simply get paid for your work.

These companies trust us

Invoice without a company

With Invoice, you can invoice your customers, private or corporate, and get paid after tax. We take care of accounting and reporting to the Norwegian Tax Authorities.

Invoice with a company

Use your company to invoice the customer, and get paid directly to the company account. Invoice both private individuals and companies through Invoice - have everything in one place.

See how we can help you as a freelancer

Lidya, freelancerWith Manymore, I don't have to think about the invoice and payment process. This means I have more time and energy to focus on my professional development in a new country while I look for my dream job.

We have your needs covered

Take control of invoicing and payout today

Register for free, and send your first invoice today!

- Register for free

- Pay-as-you-go

- We handle security and GDPR

- Support guaranteed