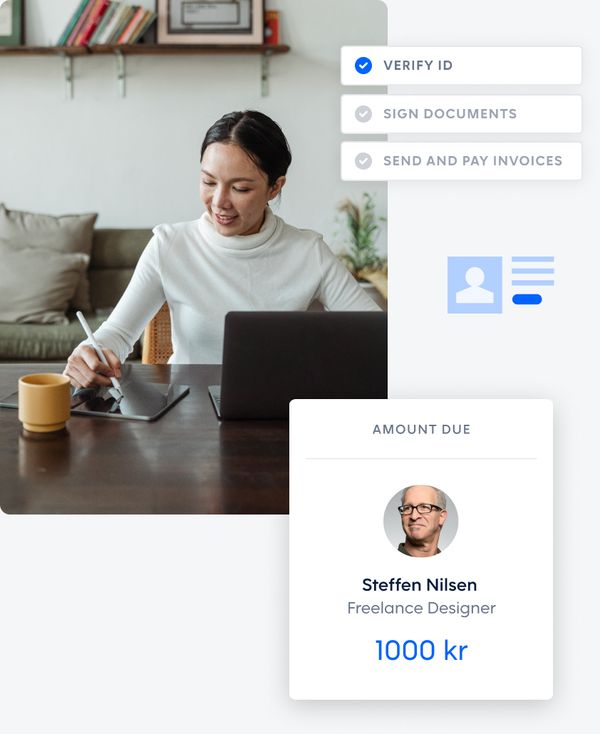

Invoicing made easy

Invoicing should be hassle-free for everyone. Send an invoice for free with Invoice and keep everything in one place.

These companies trust our invoicing process

With Earnmore, you can keep all invoices in one place, no matter who you're invoicing.

Send invoices to all your customers, no matter if it’s a company or a private individual.

You can send invoices as PDF for free with Earnmore.

Invoicing causes stress and headaches

Luckily, we are experts in this field. Invoice was developed to help our freelancers with their invoicing and payout.

Keep everything in one place with Invoice

Invoice all your customers, both companies and individuals, and keep it all in one place.

Manymore benefits program

With our benefits program you can enjoy discounts on everything from accounting services to sunglasses and holidays.

Functional invoicing

Intuitive interface.

We integrate directly with Fiken for easier accounting.

Use our templates or set it up however you want.

We’ve got your freelance needs covered

See how we have helped our customers

Lidya, freelancerWith Manymore, I don't have to think about the invoice and payment process. This means I have more time and energy to focus on my professional development in a new country while I look for my dream job.

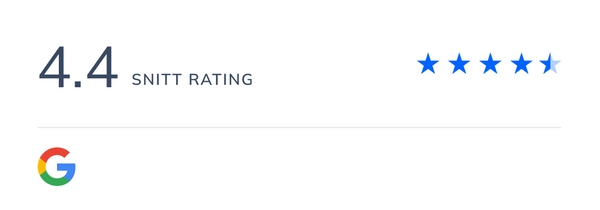

- Fantastic service with great customer service at a very professional level. Highly recommended!

Carl Fredrik

user, invoicing services

Take control of your invoicing today

Register for free and send your first invoice within minutes.

- Register for free

- Pay-as-you-go

- Your data is secure

- Support guaranteed